Welcome to the exciting world of Forex trading online! Whether you’re a seasoned trader or just beginning your journey in the financial markets, there’s always something new to learn and explore. In this article, we’ll delve into the fundamentals of Forex trading, the tools and strategies you can use, and how to navigate this complex landscape effectively. For a deeper exploration of Forex trading resources, visit forex trading online exbroker-turkiye.com.

What is Forex Trading?

Forex trading, also known as foreign exchange trading, involves buying and selling currencies in pairs. It’s the largest financial market globally, with a daily trading volume exceeding $6 trillion. The Forex market operates 24 hours a day, five days a week, providing traders with ample opportunities to engage in currency trading at any time.

The Basics of Currency Pairs

Currencies are traded in pairs, such as EUR/USD or USD/JPY. The first currency in the pair is known as the base currency, while the second is the quote currency. Forex traders aim to profit from fluctuations in exchange rates between these currencies. For example, if you believe the Euro will strengthen against the US Dollar, you would buy the EUR/USD pair. Conversely, if you think the Euro will weaken, you would sell the pair.

Key Concepts in Forex Trading

To be successful in Forex trading, it’s essential to understand several key concepts:

- Pips: A pip is the smallest price move that a given exchange rate can make. In most currency pairs, it is equal to 0.0001.

- Leverage: Leverage allows traders to control larger positions with a smaller amount of capital. While it can amplify profits, it can also increase losses.

- Margin: Margin is the amount of money required to open a trading position. It serves as a good faith deposit to the broker.

Choosing a Forex Broker

Selecting the right Forex broker is crucial for your trading success. Here are some factors to consider:

- Regulation: Ensure that the broker is regulated by a reputable authority to guarantee the safety of your funds.

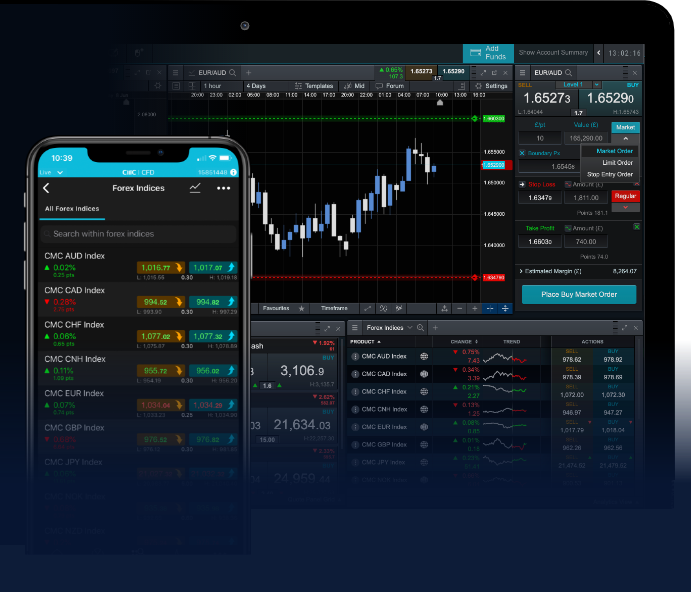

- Trading Platforms: Look for brokers that offer user-friendly and robust trading platforms, such as MetaTrader 4 or 5, which provide advanced charting tools and analysis resources.

- Spreads and Fees: Be aware of the spreads and any additional fees that may apply to your trades. Lower costs can significantly impact your overall profitability.

Developing a Trading Strategy

A well-defined trading strategy is essential for success in Forex trading. Here are some popular strategies that traders often apply:

- Scalping: This strategy involves making small profits on numerous trades throughout the day.

- Day Trading: Day traders buy and sell within the same trading day, aiming to benefit from short-term market movements.

- Swing Trading: Swing traders hold positions for several days or weeks, focusing on medium-term price movements.

Technical Analysis vs. Fundamental Analysis

Traders often rely on two primary methods to analyze currency pairs: technical analysis and fundamental analysis.

- Technical Analysis: This approach focuses on historical price movements and chart patterns to predict future behavior. Common tools include trend lines, support and resistance levels, and various indicators like moving averages.

- Fundamental Analysis: This method involves analyzing economic data, news reports, and geopolitical events to determine their impact on currency values. Economic indicators, such as GDP, employment rates, and inflation are key components of this analysis.

Managing Risks in Forex Trading

Risk management is vital for any trader. Here are some tips to help you manage risk effectively:

- Set Stop-Loss Orders: A stop-loss order allows you to limit your losses on a trade, automatically closing your position when a specific price is reached.

- Diversify Your Portfolio: Avoid putting all your capital into one trade or currency pair. Spread your investments across different trades to minimize risk.

- Use Leverage Wisely: While leverage can enhance your potential earnings, excessive leverage can lead to substantial losses. Determine your risk tolerance before applying leverage.

Keeping Updated with Forex News and Events

Staying informed about global economic events and news is essential for successful Forex trading. Economic calendars serve as valuable resources for tracking upcoming events that may affect currency prices. Keep an eye on interest rate decisions, employment reports, and geopolitical developments, as these factors can create volatility in the Forex market.

The Importance of a Demo Account

Before risking real money, it’s wise to practice with a demo account. Most brokers offer this feature, allowing you to trade in a virtual environment with simulated funds. This practice will help you sharpen your trading skills, test your strategies, and build confidence without financial risk.

Conclusion

Forex trading online is an exciting venture with the potential for substantial profits, but it also comes with significant risks. By understanding the fundamentals, developing a solid trading strategy, and maintaining discipline, you can navigate the Forex market more effectively. Remember to stay informed, manage your risks, and continuously seek to improve your trading skills. Whether you’re aiming for short-term gains or long-term investment, the world of Forex trading offers endless possibilities for those willing to learn and adapt.